|

|

|

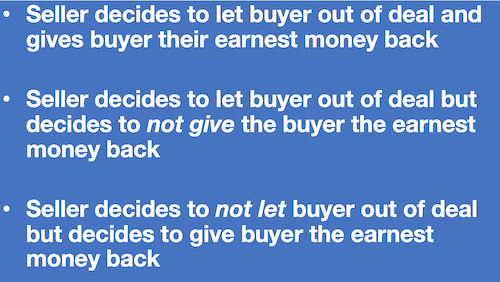

Earnest Money in a Hot Sellers Market As the name implies, Earnest Money is an indicator of how earnest a buyer is in submitting an offer to you as the seller. The buyer is at risk of losing this money if the deal were to fall through for reasons beyond the contingencies written into a purchase agreement. The normal contingencies are defects discovered during an inspection, the appraisal and the final loan approval from the lender. Buyers need to have skin in the game as they say to insure that they just do not simply change their mind and decide to walk away from the purchase of a home. Walking away can have a devastating effect on sellers and all other parties involved. Such an occurence can effect multiple parties as it is typically a ripple effect. An example might be that Seller A receives an offer from Buyer B and while waiting to close on the transaction Seller A writes an offer to purchase a new home from Seller C that is contingent of Seller A closing on the sale of their current home, and then Seller C writes an offer on a home from Seller D, and so on and so on. You can easily see from the example above that if Buyer B decides to simply walk away from the deal with Seller A many parties are affected. There are many costly factors to consider such as movers having been hired, furniture and belongings packed, inspections and appraisals having been paid for, title search having been performed and home repairs possibly paid for and done after the inspection, and so on. In Indiana, the typical amount of earnest money is 1% of the sales price. While that may seem like a lot of money, to some buyers it may not be enough to discourage them from attempting to walk away from a deal. I was recently involved in a transaction where a buyer simply decided to walk away and gave up their $6,000 in earnest money to the sellers to do so. It is also important to note that as a seller you do not automatically have to let a buyer out of a deal if the reason for them wanting to walk away is not a legitimate contingency that was written into the purchase agreement. A few possible outcomes could be:  It is important to note that the disposition of the earnest money is not simply in the hands of the seller to decide even though they are the ones most affected by the buyer deciding to simply walk away. It may be very clear that a buyer has no legitimate right to walk away from a deal AND YET they may ask for a mutual release from the deal AND request their earnest money be returned to them. If a seller and a buyer agree to let a buyer out of the purchase agreement but do not agree on who keeps the earnest money, then it is up to the principal broker of each of the two real estate agencies involved in the transaction to decide what is fair based on the facts. There is a 60 day waiting period between when a mutual release is signed by both parties and when the brokers meet to decide the fate of the earnest money. The thought is that during the 60 day period both sellers and buyers will eventually come to a mutual agreement on the disposition of the earnest money. If they don't, the brokers decide. If either party disagrees with the decision of the brokers then they will have to take the other party to small claims court to seek a remedy. The unfortunate reality is that the amount of the earnest money involved may be insignificant in comparison to the amount in attorney fees if it does go to court. On a $600,000 house with $6,000 in earnest money it MIGHT be worth it, but clearly on a $100,000 house with $1,000 in earnest money it would not be. What you as the seller do not want is to lose time on market and potentially lose out on attracting another buyer while waiting on the disposition of the earnest money. The safest option in this scenario would likely be to send the buyer a mutual release letting them out of the contract, BUT NOT agreeing to give them the earnest money back. What you want is for them to either sign that mutual release or for them to draft and send you their own mutual release that calls for them to get their money back. Once both parties have signed a mutual release, regardless if it is the same mutual release, the original purchase agreement is no longer valid. Once this happens, the seller can put their home back on the market and accept another offer from a different buyer. The only thing that remains to be decided in this situation is the disposition of the earnest money within the 60 day period. As a seller, you do not have to simply let a buyer out of the contract if they don't have a legitimate reason to do so, regardless of how much earnest money you may potentially receive. In this hot sellers market it is very likely that you could obtain a new buyer very quickly and everything is fine. As a seller, you need to gauge how the loss of the buyers you have affects you both financially and emotionally. What if you had found your dream home and you could no longer purchase it because you no longer can close on the sale of your current home in a timely manner to then purchase the new home? What if you purchased a new home already without waiting to close on the sale of your current home, would that change your decision to let a buyer out of the deal? I am not an attorney, nor do I play one on TV, and I am not giving you legal advice. I am only sharing my experiences in real estate and an opinion. You should always seek legal advice and I can recommend several very good real estate attorneys to you. In my experience over the past 18 years, there are not that many real estate deals that end up falling through. More often than not, deals fall through for inspection issues that cannot be resolved. The reality in Indiana is that our attorney approved purchase agreements favor the buyers more so than the sellers in that there are several contingencies written into an offer that allow for a buyer to have a legitimate reason to walk away from a deal. For this and many other reasons you need an experienced real estate agent like myself to represent you and advocate for your rights.

|

|

|

|

It is a common misconception that a real estate agent primarily learns of someone looking to buy or sell a home when someone simply calls an agency looking for an agent to help them. Although this can happen, it is very rare. In fact, over 80% of the referrals I receive come from past clients and past coworkers just like you. The other 15-20% of referrals comes from our national network of relocation companies and other Coldwell Banker agencies across the country. The greatest compliment I can receive is when someone like you refers me to a friend, coworker or family member of theirs. If you, or someone you know, are looking to either buy or sell a home then I would certainly appreciate the opportunity to earn your business. Do you know of someone looking to buy or sell a home?  Click the vCard below to download my contact information to load on your phone and to share with anyone you know that would benefit from my help in buying or selling a home.

|

|

|

12401 Old Meridian Street Carmel, In 46032 Email brad@btgough.com Mobile (317) 590-3571 Office (317) 844-1131 Website www.btgough.com |