|

|

Multiple Offers in a Hot Sellers Market

The Real Estate Market continues to experience Low Inventory and record Low Interest Rates and as you might expect it continues to be a Sellers Market.

It pays to work with an experienced Real Estate Agent to help guide you through the process of how to handle Multiple Offers when you are selling your

home.

Many sellers have not experienced getting multiple offers simultaneously and as a result there are several myths out there about what they need to do

when this happens.

I have helped many sellers over the years who have received multiple offers after listing their home for sale, some as many as 12 on the first day on

market. Many sellers will look at the offers presented and automatically assume that the highest price offered is the best offer. An experienced agent

like myself understands that there are many components to an offer that could make a lower sales price offer even more attractive to a seller than a

higher priced one.

A good agent will work with you to understand what is most important to you in an offer and organize the offers side by side when presenting them to

you for you to make an informed decision. There are many factors to consider including but not limited too:

Cash is King as the saying goes and generally speaking a cash offer is considered better than an offer that has a contingency that a buyer be qualified

for a loan to purchase your home. Your agent should always require that a Pre-approval letter from the buyers lender be provided with their offer,

however, this is not a guarantee that the buyer will ultimately get final approval and a clear to close from their lender on the day of closing.

Many things can and sometimes do happen between the time you accept an offer and when you close, including job loss and divorce. Another important

thing to remember is a lender requires that the home appraise for the agreed upon sale price. If the home does not appraise for sales price then

someone will have to make up the difference between the agreed upon sales price and appraisal price. Not all buyers have the extra money available to

make up this difference or want to do that once they have the impression that they may be overpaying for the home. While appraisals are simply an

opinion of the homes market value, once a buyer has that opinion of price in their head it can be a challenge to overcome.

It is also important to consider how much money the buyer is putting down or has available to put down on the loan they are getting. A buyer that is

putting down say 20% on a $400,000 loan has been qualified by their lender as having $80,000 available for down payment. In contrast, a buyer only

putting down 5% MIGHT only have $20,000 to put down on the loan. For buyers putting down less, your agent should confirm with their lender if they

have more to put down and are only putting down less for a particular reason. One example could be that the buyers have a home already that they are

not going to sell before purchasing your home and will list it for sale AFTER they purchase your home. They may have a lot of untapped equity in

their current home and will pay down their new loan after closing on the purchase of your home.

Buyers that have more money available to put down on a loan also have more money available to make up an appraisal gap. In this highly competitive

market, I am seeing more and more offers that include provisions for a buyer to make up all or a portion of an appraisal gap to make their offer as

attractive as a cash offer. A buyer that is qualified to put down say 20% on a loan is possibly also qualified to only put down say 10% and then use

that extra 10% to bring more money to closing to make up the appraisal gap if it should occur. I do not envy appraisers right now with sales prices

increasing so rapidly and trying to determine a homes true market value with not all sales recorded in time for them to make that determination.

The amount of earnest money that a buyer is putting down initially with their offer is also important when comparing offers. The more skin in the game

that a buyer has the less likely they would try to get out of the deal for reasons that are not legitimate. They stand to lose that money otherwise.

Earnest money is typically around 1% of the sales price. In a multiple offer situation buyers are offering much more than 1% to make their offers more

attractive.

In todays bidding war environment, escalation clauses are becoming more and more common. Basically, an escalation clause states that the buyer is

offering to beat all other offers by some amount up to a certain limit. As an example, a buyer may offer $400,000 for a home and also include an

escalation clause that states they will beat all other offers by $2,000 up to a high of $420,000.

An experienced agent will help you understand the nuances of such offers. One thing to remember is if you receive multiple offers

that include escalation clauses then each of those offers can and will trigger the other offers to go up in price towards their limit.

An example could be Buyer A is getting a loan and offers $400,000 with an escalation clause that says they will beat all other offers by $2,000

up to $420,000. Buyer B is paying cash and offers $405,000 with an escalation clause that states they will beat all other offers by $500 up to

$410,000. When only considering price, the offer for Buyer A is escalated to $412,000 because they agreed to beat all offers by $2,000 and the

highest Buyer B agreed to go was $410,000. However, an offer of $412,000 that requires a loan may not be as attractive as an offer of $410,000 that

is a cash offer. If the seller decides to go with Buyer A, the sales price would be $412,000.

Another provision I am seeing a lot of in this market is buyers accepting a home in as-is condition with no inspection or possibly stating that

they will not ask for any repairs to be made unless the cost of those repairs exceeds some sort of high dollar limit, e.g. $5,000. While I would

never advise a buyer client of mine to make an offer like this, sometimes it can make sense to make an offer as competitive as possible with so many

buyers competing for so few homes. The newer the home the less risky this kind of offer might be. An older home is likely have a few more major repairs

needed. Rather than just buying as-is, it likely makes more sense to go the route of putting in a high dollar limit on repairs that cannot be

exceeded for needed repairs.

In a normal market, buyers have the luxury of visiting a home multiple times before deciding to write an offer. During those visits they will likely

consider items such as the age of the roof, HVAC system, water heater, water softener, appliances, windows etc. They will look at these items as well

as comparable sales nearby to try and determine what a fair price would be based on anticipated repairs and updates possibly needed. In a low

inventory market and multiple offer situation buyers are faced with offering more than they may have been comfortable with otherwise if they had more

time to do the proper analysis.

Another important item to consider on all offers is the closing date and possession date that the buyers are asking for. When comparing offers

side by side, be sure the dates that work for the buyers also work for you as the seller. That is not to say that these items are not negotiable.

In fact, if you should receive multiple offers, your agent should work with you determine what items are the most important to you and communicate

those needs to all agents that have presented offers. If you know some or all of these items in advance, it might make sense to advertise those

requirements in the listing. All offers are negotiable.

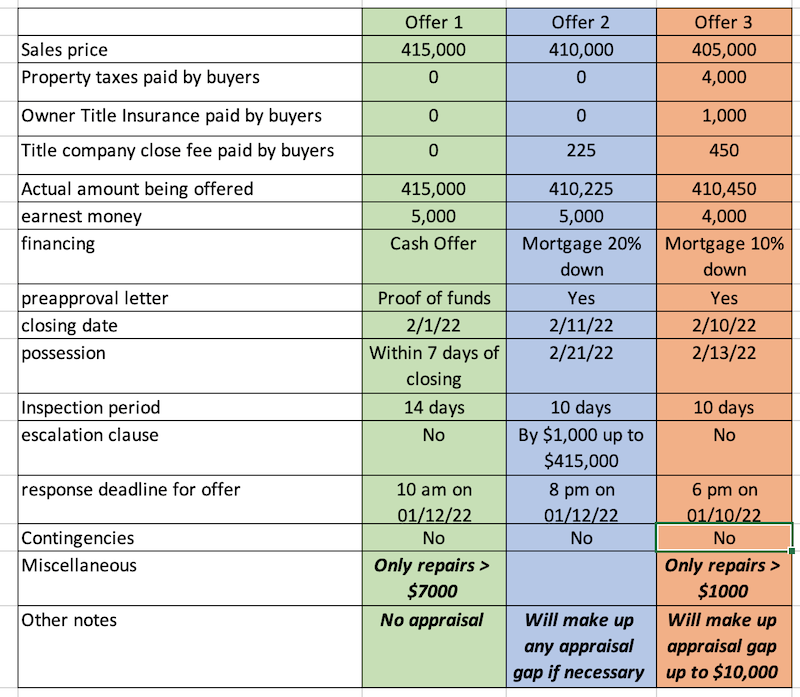

In comparing offers side by side, your agent should also consider items that the buyers may be offering to pay for that are typically seller expenses.

Some examples include unpaid property taxes, owners title insurance policy and the title company closing fee. To get a true comparison of the offers

you have, these items need to be accounted for. I typically like to use a spreadsheet to compare the key components of offers in a side by side

comparison to make it easier for my seller clients to digest the information being presented. An example of such a spreadsheet is as follows:

It is important to note that you as the seller you do not have to accept any offer you receive. You can reject them all. You can also choose to work

with one offer at a time even if you should receive multiple offers. You should keep in mind that all offers have deadlines to respond to them by and

if you miss that deadline then the offer is no longer valid. So be careful. We may not always be in a market that is so favorable to sellers and you may

not have as many options as you have right now.

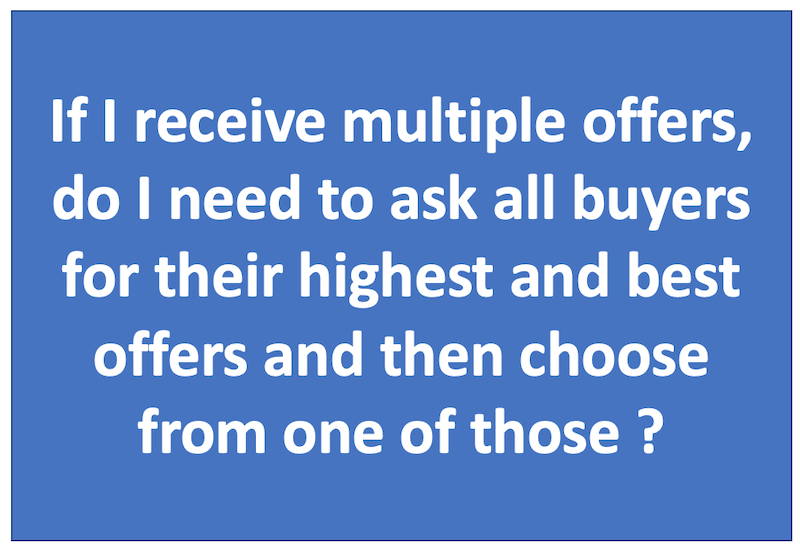

When you do receive multiple offers, you can choose to simply work with the one that is most favorable to you and hope to get a deal accepted quickly.

You can also choose to have your agent notify all of the other agents that you have received multiple offers and that you would like them to resubmit

their highest and best offers by a specific date and time. When making this kind of notification, your agent should communicate the same message and

timelines identically to each buyers agent.

I hope this article gives you some insights into the intricacies involved in a multiple offer scenario when you are selling your home.

There is certainly more involved then I could possibly highlight here and each real estate transaction is unique.

I believe integrity and experience do matter and I have a great deal of both of these to help my clients navigate this process.

Over $110 Million in Career Sales

|

|