|

|

Housing Market Questions

The market has shifted, and that is a good thing. Demand and sales are headed back to pre-pandemic levels, which were some of the strongest in

recent history. But, the shift has caused a great deal of confusion and uncertainty.

The main questions buyers and sellers are asking right now are:

Is the housing market going to crash?

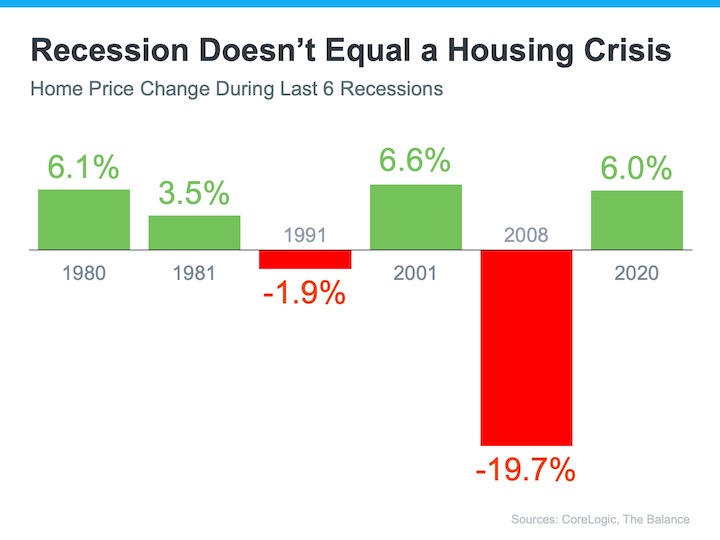

Hearing talk about a potential recession? Wondering what that means for the housing market? Know that an economic slowdown does not equal a housing crisis.

In 4 of the last 6 U.S. recessions, home prices actually increased.

What is happening with mortgage rates, now and in the future?

Rising mortgage rates are no doubt one of the biggest factors impacting the housing market right now. But it is important to remember that the low rates of

the last few years were an anomaly.

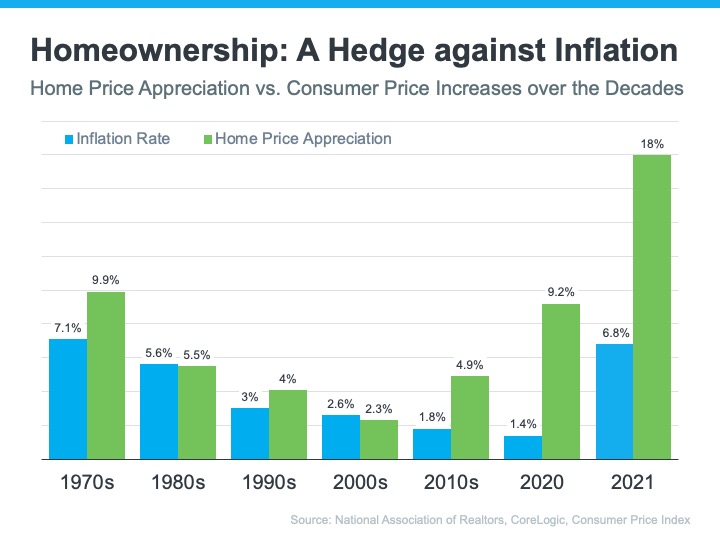

As inflation rises and mortgage rates climb, many may see their purchasing power shrink and their dream of homeownership fade.

However, it is important to remember one big piece of economic wisdom: there is no better hedge against inflation than homeownership.

A home is a tangible asset that typically holds or grows in value. In most decades, home prices have outperformed inflation. If you are thinking

about buying a home today, know that history shows homeownership is a good hedge against inflation.

If the economy slows further, what does that mean for real estate?

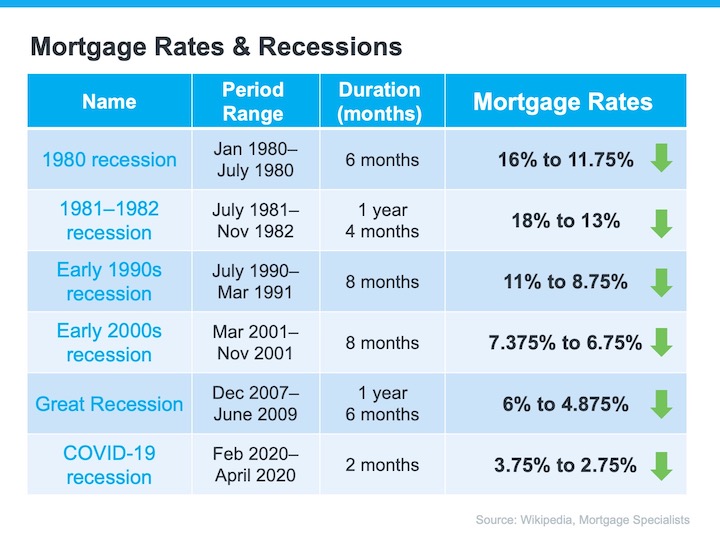

Historically, each time the economy slowed down, mortgage rates decreased.

And while history does not always repeat itself, we can learn from it. While an economic slowdown needs to happen to help taper inflation, it

has not always been a bad thing for the housing market. Typically, it has meant that the cost to finance a home has gone down, and that is a good thing.

What will happen the second half of this year?

Yes, we are seeing a slowdown. However, we are really just heading back toward the market pace we saw pre-pandemic, and those were still great years

for real estate.

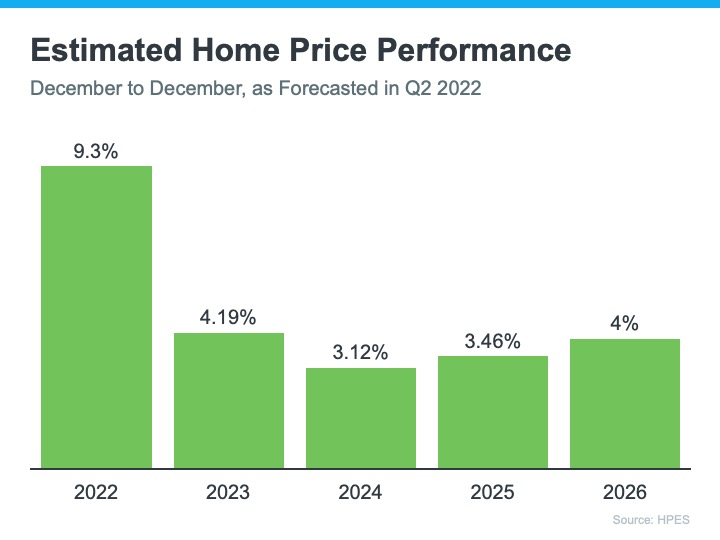

Focus on the big picture, and that is this: the housing market is still very strong, and previous projections are already outperforming what

industry experts forecasted earlier this year.

If you buy now, you will best those future increases. And once you do own the home, any price appreciation that occurs will grow your homes value

and your net worth.

Should I wait to buy a home?

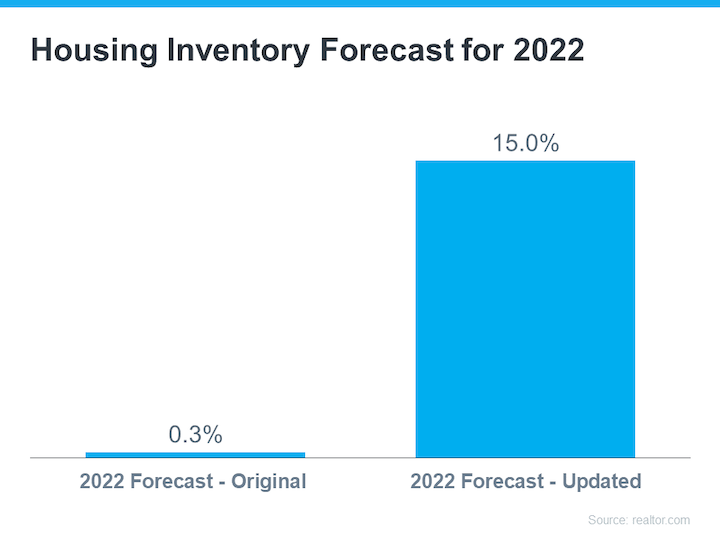

Even though purchasing a home today may not be as easy as it was a couple of years ago, the latest data shows that inventory levels are rising,

which means more moderate price appreciation and more options for buyers.

Experts say home prices will continue to appreciate in the coming years. If you buy now, you will best those future increases. And once you do own the

home, any price appreciation that occurs will grow your homes value and your net worth.

Check out my newest listing in Greenwood! Click on the photo to learn more.

Over $115 Million in Career Sales

|

|