|

|

|

|

The homestead tax exemption is very important in Indiana because it reduces the amount of property taxes you pay on your home. All property exemptions must be filed no later than December 31st! You must re-file your exemptions if you: In Indiana, the Homestead tax exemption exempts $45,000 from property taxes. They are called homestead exemptions because they apply to your primary residence, not rental properties or investment properties. You must live in the home to qualify for the tax break. Indiana has a 1% property tax cap on primary residences, 2% on rental properties and 3% on commercial properties. As a simple example, let us say the assessed value of your home is $200,000 and your property tax rate is 1%. Your property tax bill would equal $2,000. But if you were eligible for a homestead tax exemption of $45,000, the taxable value of your home would drop to $155,000, meaning your tax bill would drop to $1,550. Additionally, Indiana exempts another $3,000 from property taxes if you have a mortgage on your home. In the example above, with a homestead and mortgage tax exemption in place the taxable value of your home would drop to $152,000, meaning your tax bill would drop to $1,520. If you purchased a new home this year, the title company should have filed your homestead tax exemption for you. They do not however file your mortgage exemption for you. You will need to file for this at the county auditors office where you live. While you are filing for your mortgage exemption you should request a receipt from the auditor to ensure your homestead tax exemption is in place. 201 Courthouse Square Lebanon, IN 46052 765.482.2940 Hamilton County 33 N. 9th Street Suite L21 Noblesville, IN 46060 317.776.8400 Hancock County 111 S. American Legion Place Suite 217 Greenfield, IN 46140 317.477.1105 Hendricks County 355 S. Washington Street Suite 202 Danville, IN 46122 317.745.9300 Johnson County 86 W. Court Street Franklin, IN 46113 317.346.4310 Marion County 200 E. Washington Street Suite 801 Indianapolis, IN 46204 317.327.4652 North Office 951 E. 86th Street Suite 110 Indianapolis, IN 46240 317.327.4907 South Office 5226 Elmwood Avenue Indianapolis, IN 46203 317.327.4191 East Office 7363 E. 21st Street Indianapolis, IN 46219 317.327.8888 Northwest Office 7128 Waldemar Drive Building 116 Indianapolis, IN 46268 317.327.4907 |

|

|

|

Fishers - $315,000  Noblesville - $449,900  Fishers - $299,900 |

|

|

|

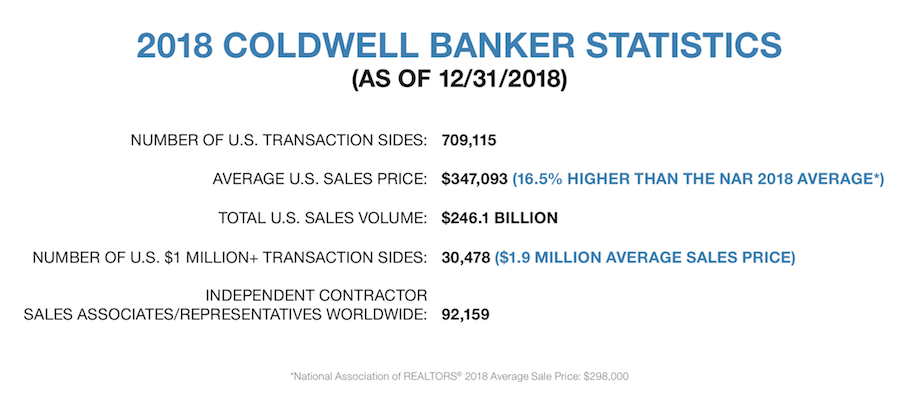

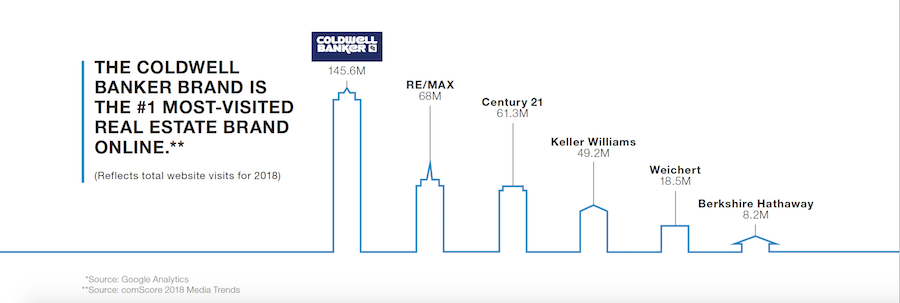

It is a common misconception that a real estate agent primarily learns of someone looking to buy or sell a home when someone simply calls an agency looking for an agent to help them. Although this can happen, it is very rare. In fact, over 80% of the referrals I receive come from past clients and past coworkers just like you. The other 15-20% of referrals comes from our national network of relocation companies and other Coldwell Banker agencies across the country. The greatest compliment I can receive is when someone like you refers me to a friend, coworker or family member of theirs. If you, or someone you know, are looking to either buy or sell a home then I would certainly appreciate the opportunity to earn your business. Do you know of someone looking to buy or sell a home?  |

|

|

Bradley Thomas Gough Associate Broker  12401 Old Meridian Street Carmel, In 46032 Email brad@btgough.com Mobile (317) 590-3571 Office (317) 844-1131 Website www.btgough.com       |

|

|

|

There are so many great charities out there that and it is very hard to decide what to donate to. My wife Elissa and I have been very fortunate and have a good life. We simply can't donate to everything, however, we are very passionate about several different causes. We are sustaining members for the following organizations and encourage each of you to donate in any way you can to a cause that you are passionate about too.

The American Society for the Prevention of Cruelty to Animals

|

|