April 2018

Your Home Expert Team

Brad Gough, Kia Albano, Sara Myers, Sumer Byram, Kim Wert, Emily Martz

|

April 2018 Your Home Expert Team Brad Gough, Kia Albano, Sara Myers, Sumer Byram, Kim Wert, Emily Martz |

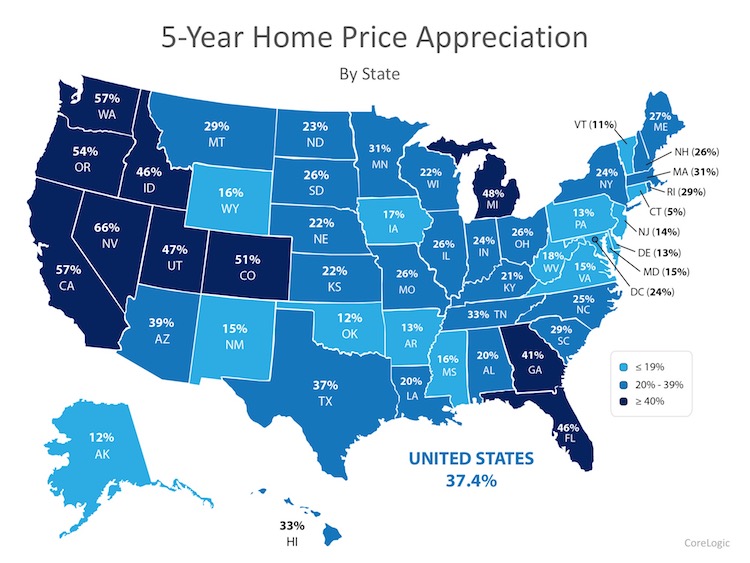

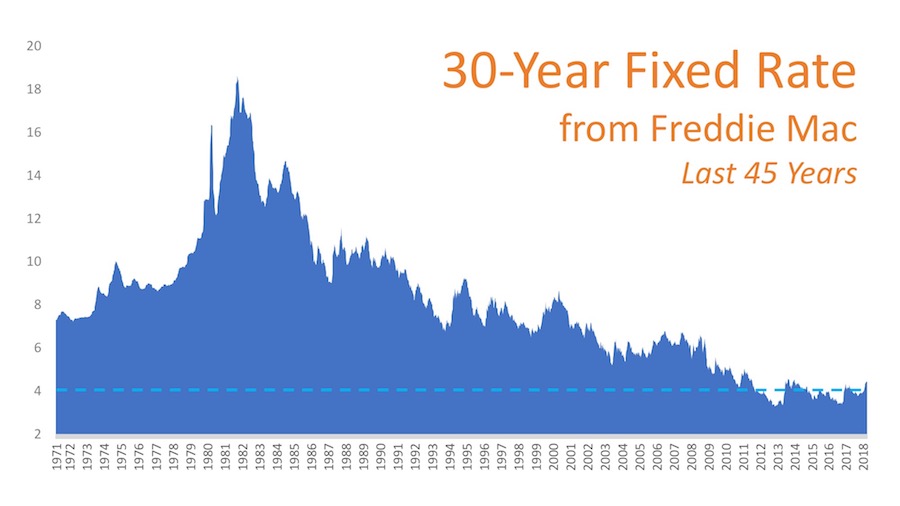

One of the key indicators used in the report to determine the health of the housing market was home price appreciation. CoreLogic focused on appreciation from December 2012 to December 2017 to show how prices over the last five years have fared. Frank Nothaft, Chief Economist at CoreLogic, commented on the importance of breaking out the data by state, Homeowners in the United States experienced a run-up in prices from the early 2000s to 2006, and then saw the trend reverse with steady declines through 2011. After finally reaching bottom in 2011, home prices began a slow rise back to where we are now. Greater demand and lower supply as well as booming job markets have given some of the hardest hit housing markets a boost in home prices. Yet, many are still not back to precrash levels. The map below was created to show the 5 year appreciation from December 2012 through December 2017 by state.  Where were prices expected to go? Every quarter, Pulsenomics surveys a nationwide panel of over 100 economists, real estate experts, and investment and market strategists and asks them to project how residential home prices will appreciate over the next five years for their Home Price Expectation Survey (HPES). According to the December 2012 survey results, national homes prices were projected to increase cumulatively by 23.1% by December 2017. The bulls of the group predicted home prices to rise by 33.6%, while the more cautious bears predicted an appreciation of 11.2%. Where are prices headed in the next 5 years? Data from the most recent HPES shows that home prices are expected to increase by 18.2% over the next 5 years. The bulls of the group predict home prices to rise by 27.4%, while the more cautious bears predict an appreciation of 8.3%. Bottom Line Every day, thousands of homeowners regain positive equity in their homes. Some homeowners are now experiencing values even higher than before the Great Recession. If you are wondering if you have enough equity to sell your house and move on to your dream home, we should get together to discuss conditions in our neighborhood! The rate you secure greatly impacts your monthly mortgage payment and the amount you will ultimately pay for your home. Do not let the prediction that rates will increase stop you from purchasing your dream home this year.  Be thankful that you can still get a better interest rate than your older brother or sister did ten years ago, a lower rate than your parents did twenty years ago, and a better rate than your grandparents did forty years ago. |

|

Current Listings |

Fishers - $479,900  Arcadia - $484,000  Indianapolis - $360,000  Indianapolis - $499,900 |

|

Do You Know Someone Looking To Buy or Sell? |

|

It is a common misconception that a real estate agent primarily learns of someone looking to buy or sell a home when someone simply calls an agency looking for an agent to help them. Although this can happen, it is very rare. In fact, over 80% of the referrals I receive come from past clients and past coworkers just like you. The other 15-20% of referrals comes from our national network of relocation companies and other Coldwell Banker agencies across the country. The greatest compliment I can receive is when someone like you refers me to a friend, coworker or family member of theirs. If you, or someone you know, are looking to either buy or sell a home then I would certainly appreciate the opportunity to earn your business. Do you know of someone looking to buy or sell a home?  |

|

Contact Brad Gough |

Bradley Thomas Gough Associate Broker  12401 Old Meridian Street Carmel, In 46032 Email brad@btgough.com Mobile (317) 590-3571 Office (317) 844-1131 Website www.btgough.com      |

|

Charities Supported |

|

There are so many great charities out there that and it is very hard to decide what to donate to. My wife Elissa and I have been very fortunate and have a good life. We simply can't donate to everything, however, we are very passionate about several different causes. We are sustaining members for the following organizations and encourage each of you to donate in any way you can to a cause that you are passionate about too.

The American Society for the Prevention of Cruelty to Animals

|